maryland digital advertising tax litigation

Or two years as the case may be. It sounds like the worlds dullest riddle but.

Cost Council On State Taxation

When is something a tax for purposes of the Permanent Internet Tax Freedom Act but not a tax for purposes of the Tax Injunction Act.

. And Marylands legal position remains a precarious one. Lets back up a minute. In March 2020 Maryland lawmakers adopted legislation.

The tax which Maryland estimates. Another lawsuit has been filed over Marylands gross receipts tax on digital advertising services this time in state court by subsidiaries of Comcast and Verizon. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of.

The formula was included to placate critics who argued the Maryland Tax would potentially reach activity outside the state of Maryland. Or two years as the case may be. The following comments were submitted to the Marylands Comptrollers office on November 8th 2021 regarding the regulation of Marylands Digital Advertising Tax.

Or two years as the case may be. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. It sounds just like.

She is one of the two tax law. A lawsuit filed against the Maryland Comptroller by the US. But it does little to resolve that issue.

Lets back up a minute. In March 2020 Maryland lawmakers adopted legislation. Earlier this month Marylands state legislature overrode a veto from the governor to pass a first-of-its-kind tax on digital advertising revenues.

We discussed the Maryland digital advertising tax lawsuit in federal court her role in that litigation and her research on digital services taxes. Chamber of Commerce and various trade groups representing large tech companies challenges the digital. In March 2020 Maryland lawmakers adopted legislation.

Lets back up a minute. And Marylands legal position remains a precarious one. And Marylands legal position remains a precarious one.

1 This tax which is intended to be imposed on the. When is one thing a tax for functions of the Everlasting Web Tax Freedom Act however not a tax for functions of the Tax Injunction Act.

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland

Maryland Adopts Online Ad Tax Against Amazon Facebook And Google The Washington Post

Maryland Enacts Nation S First Digital Advertising Tax With Strict Penalties For Noncompliance Subject To Immediate Challenges Thought Leadership Baker Botts

Amplifying Science In The Courts To Protect Children S Health Democracy Forward

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland

Maryland School Law Deskbook Lexisnexis Store

Internet Groups U S Chamber Sue Maryland Over Digital Advertising Tax Reuters

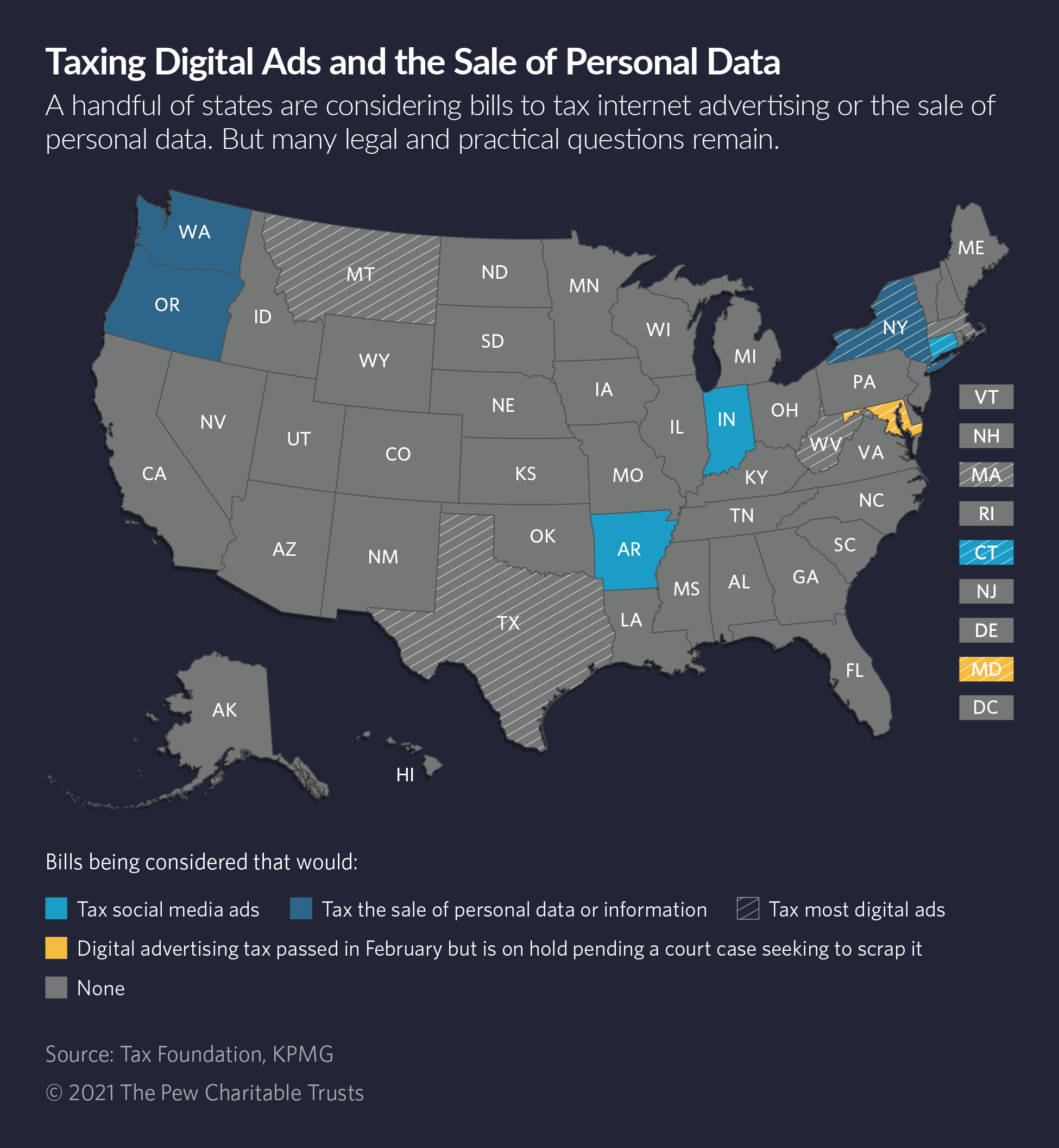

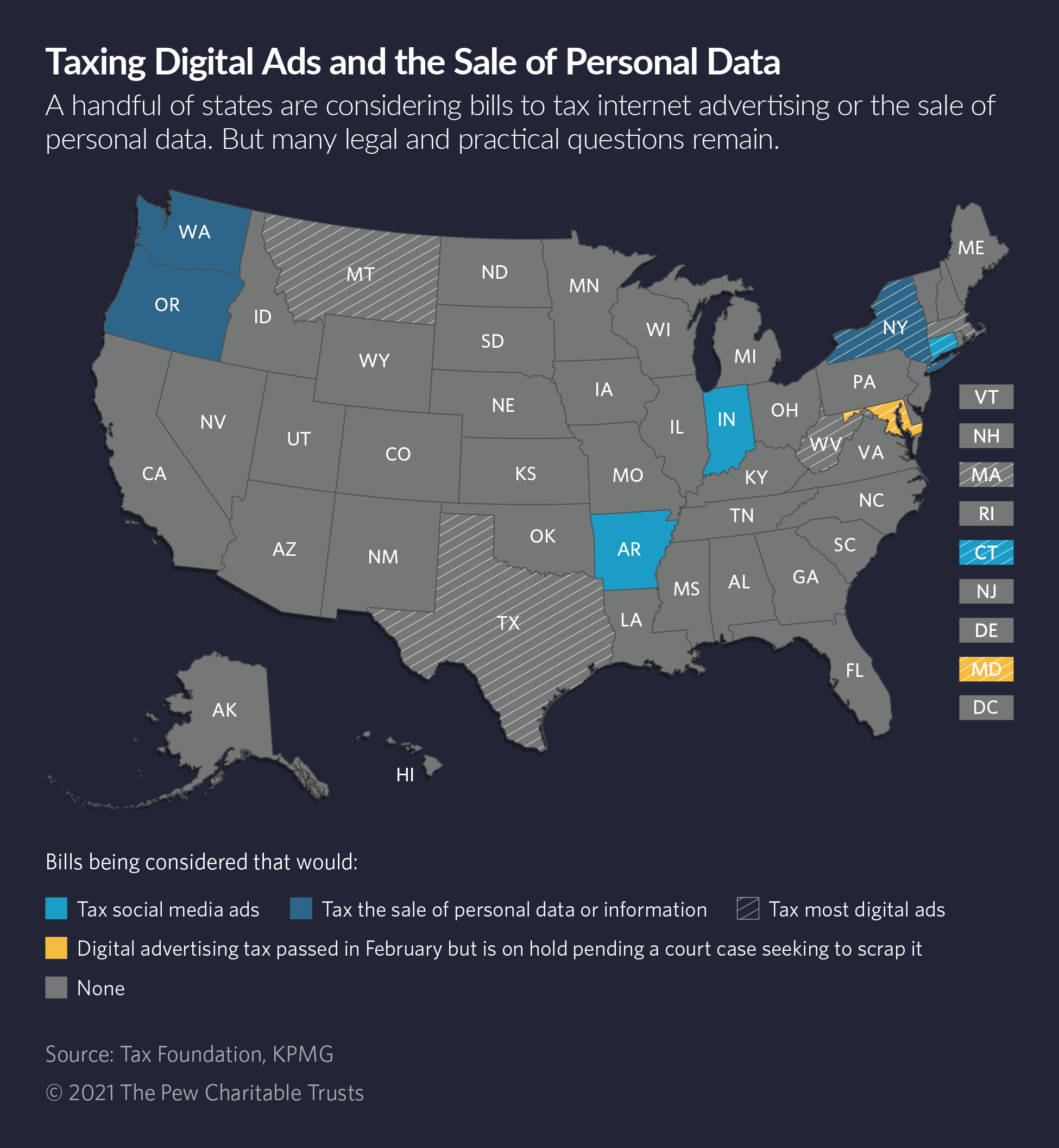

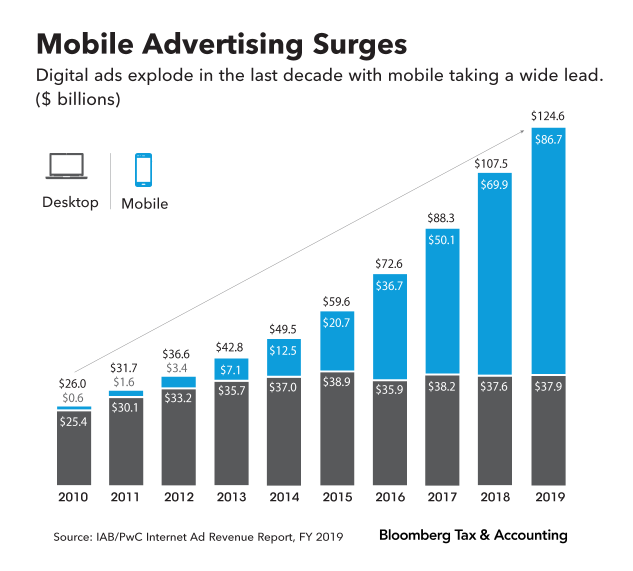

Internet Ads Are A Popular Tax Target For Both Parties The Pew Charitable Trusts

Battle Against Maryland Digital Advertising Tax Continues As First Payments Come Due

Maryland State Tax Updates Withum

Maryland Faces Lawsuit Over New Digital Ad Tax That Was Crafted To Help Pay For Kirwan Wbff

Battle Against Maryland Digital Advertising Tax Continues As First Payments Come Due

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Passes Digital Ad Tax 03 20 2020

Maryland Digital Advertising Services Tax Kpmg United States

The Fight Over Maryland S Digital Advertising Tax Part 1

Cost Council On State Taxation

New York State Budget Enacts Several Tax Increases Salt Savvy

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights